The 2021 Montana Legislature made an under-the-radar change to injury law and medical bills that severely undermines the ability of victim’s to recover the full amount of their medical bills. Instead, the new law now provides insurance companies a discount and may leave the victim having to pay medical bills out-of pocket. In other words, if you get injured by a drunk driver, you may still have to pay some of your medical bills, because the drunk driver (and his insurer) don’t have to pay the full amount. It is a law that ignores right versus wrong, just to save money for a very small and select group of insurance companies and bad actors.

You might wonder why this injury law has not received more attention. It is because the law is complicated and it is easy to miss the consequences of the law if you are not involved in the industry. I will explain here Montana injury law and medical bills.

The Language of Montana’s Injury Law and Medical Bills

In short, the law provides that a liability insurer only has to pay the discounted amount that the victim’s health insurer would have to pay. The problem is that the law does not require the medical provider to accept the discounted amount. Thus, a victim could be left with a balance.

The subject new law is found at Montana Code Annotated 27-1-308. In simple terms, for medical bills it says that liability insurers only have to pay the discounted amount a health insurer would have to pay, even if health insurance is not paying. The law is as follows:

MCA 27-1-308…(2) In an action arising from bodily injury or death, a plaintiff’s recovery may not exceed amounts actually:

(a) paid by or on behalf of the plaintiff to health care providers that rendered reasonable and necessary medical services or treatment to the plaintiff;

(b) necessary to satisfy charges that have been incurred and at the time of trial are still owing and payable to health care providers for reasonable and necessary medical services or treatment rendered to the plaintiff;

(3)….. Evidence admissible to establish the reasonable value of medical services or treatment is limited to evidence identifying the amounts actually:

….

(b) necessary to satisfy the financial obligation for medical services or treatment rendered to the plaintiff that have been incurred but not yet satisfied. This evidence may not include any reference to sums that exceed the amount for which the unpaid charges could be satisfied if submitted to any health insurance covering the plaintiff or any public or government-sponsored health care benefit program for which the plaintiff is eligible, regardless of whether the incurred but not yet satisfied charges have been or will be submitted to the plaintiff’s health insurance or public or government-sponsored health care benefit program.

Ok, so that’s a lot of legal language but let me break it down and explain the consequences. Historically (before this law), the measure of damages you can claim in a lawsuit for medical bills is the amount charged by the hospital for medical bills. Sounds simple and logical enough — it was, and that is why it has been the law for as long as Montana has had law. But insurance companies want a discount, and that is what the Montana legislature gave them on a silver platter: discounted justice.

Now, instead of paying the full medical bill, liability insurance companies only have to pay the discounted amount that YOUR health insurer would have paid, even if the health insurer didn’t pay. Injury law and medical bills are complicated, so I will break this down to show why it is bad, and won’t work.

How Injury Law and Medical Bills work in Montana

When you are injured as the result of someone’s negligence (car accident, medical malpractice, semi accident, property liability, etc.), it likely leads to medical treatment and therefore medical bills. For this example we assume you are a person who suffered a shoulder injury requiring surgery as a result of being hit by a drunk driver. You received a medical bill from the hospital, and you are required to pay that bill somehow. But you may or may not know that there is not necessarily a set amount for any given medical bill.

Medical billing has become complicated depending on the type of insurance. In general, below is an example, keeping in mind that this a a very rough hypothetical just meant to demonstrate a typical bill. For this example, let’s assume we are talking about a bill for a MRI for your injured shoulder and the hospital charges $1000 for that bill. Here’s a rough breakdown of how that bill may be paid by depending on type of insurance:

- Uninsured Self Pay or Cash: The provider will likely charge the full rate of $1,000.

- Private or Group Health Insurance: The bill will likely be discounted slightly, perhaps to around $900. Depending on copays and deductible, the $900 will be paid by some combination of the insurance and you out-of-pocket.

- Public Health Insurance (Medicaid/Medicare): The bill will likely be discounted significantly, perhaps around $300-$500. The hospital accepts as full payment. The bill is paid by Medicaid/Medicare, with possible co-pay for Medicare recipients.

- Workers’ Compensation Insurer: Like private insurance, the bill will be discounted slightly, likely to around $700-800 and paid by the workers’ compensation insurer. The hospital accepts as full payment.

- The drunk driver or his Liability Insurance before the 2021 Change: Full $1,000

The amount the hospital is paid varies dramatically based on the type of insurance. The above amounts are really rough estimates, but the point is that medical bills are discounted for health insurers.

There’s reasons for this – health insurers offer guaranteed payment for approved services, and importantly, YOU PAY FOR HEALTH INSURANCE (the exception might be Medicare/Medicaid, which is still paid by you/everyone via taxes). You pay for the guarantee of coverage, and the health insurers are able to negotiate these discounts with providers in advance based on the surety of payment. Additionally, the provider must accept the amounts ultimately paid, including co-pays and deductibles, as full satisfaction. Make no mistake, you and your insurer may get a discount, but be sure you paid significant money in premiums to get this discount. Here’s an article going into some detail about health insurer discounts, and reasons for them.

This brings us back to MCA 27-1-308 and its application to injury law and medical bills. Liability insurers (the drunk driver’s insurer) started making a stink that they were having to pay the full $1,000 in the above example when other insurers paid less, without realizing the reasons that health insurers get discounts

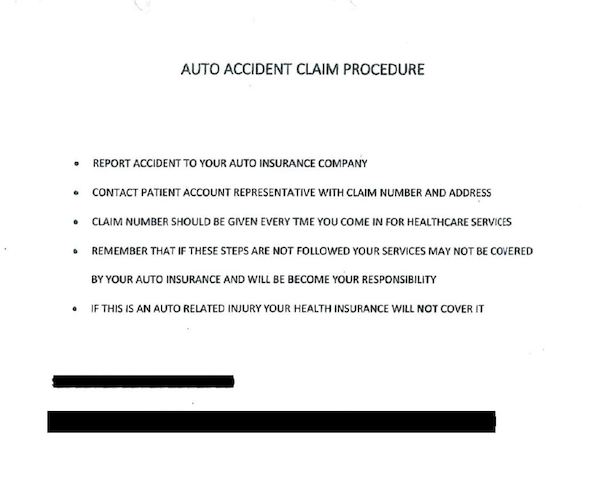

Hospitals have long realized that when liability insurance is involved (drunk driver), they can perhaps recover the full $1,000, instead of submitting the bill to the patient’s health insurer who pays discounted amounts. Hospitals have therefore developed systems where they require new patients to tell them whether the treatment is a result of negligence of a bad actor who might have insurance. If the answer is yes, hospitals will usually refuse to bill health insurance (private, group, Medicare, Medicaid, etc.). Hospitals will even tell people they cannot bill their health insurance, which may not be true or perhaps even legal, but it’s become the norm. For example, here’s an actual form one of our clients was given by a hospital:

The new law allows the drunk driver, or the drunk driver’s insurance company, to gain the benefit of your insurance. Instead of paying your full medical bill, the new law allows the drunk driver’s insurance company to only pay the amount that YOUR health insurer “could” pay, even when it didn’t pay. And importantly, unlike with health insurance where the provider must accept the discounted amount as full payment, per this bad law, the provider does not have to accept the discounted amount as full payment.

In other words, the liability insurer now gets the benefit of your health insurance premiums, and resultant discounts. It’s essentially allowing the drunk driver (and his insurer) to get a windfall off the back of your health insurance premiums, without having to pay for it, and sticking you with any balance. It’s a perversion of injury law and medical bills.

Here is an example of how it might play out if you are injured in a crash —

Say you are the victim of the drunk driving, and you are also a person who has private insurance and have paid thousands in premiums over the years for that insurance. You go in for the $1,000 MRI. First, the hospital tells you they cannot and will not bill your private insurance. You must pay the full $1,000. Then, using the new law under MCA 27-1-308, the drunk driver’s insurance company will only have to pay you the amount your health insurer would pay, say $900, “regardless of whether…charges… will be submitted to plaintiff’s health insurance.” MCA 27-1-308(3)(b). Under the statute, it does not matter whether the hospital actually bills your health insurer or not, the drunk driver’s insurer enjoys the benefit of the theoretical discount.

The drunk driver’s insurance pays you only the discounted $900, which you then pay to the hospital, but it doesn’t cover the whole $1,000 bill. You still have $100 balance with the hospital. The new law does NOT require the hospital to accept the discounted amount as full payment. Maybe they will, but maybe not.

Thus, after paying thousands in premiums for health insurance for years, the hospital refuses to use your health insurance. Furthermore, you must pay the remaining $100 balance out of pocket. The drunk driver and his insurer save $100, and also enjoy the benefit of you having paid for health insurance premiums over the years.

If you have Medicaid/Medicare, at least you didn’t have to pay huge premiums throughout the years, but the result is even worse for you. Again, even though Medicare/Medicaid would normally pay the bill for only about $300, the hospital refuses to bill Medicare/Medicaid. Yet, the drunk driver’s insurance, via MCA 27-1-308, gets to enjoy the benefit of your Medicare/Medicaid and only pay you $300. You then pay the hospital $300, and have a balance of $700 left at the hospital for you to pay. In this case, the drunk driver and his insurer hit the lottery because they get a big discount on the bill. And, theoretically you would end up paying more than the drunk driver by paying the remaining $700.

To be clear, here is the math from the above example:

Private Insurance

- Hospital Charges = $1,000

- Drunk Driver’s Insurer pays only your health insurer’s discounted amount = $900

- You Pay = $100 (plus whatever you paid for health insurance premiums)

Medicaid/Medicare

- Hospital Charges = $1,000

- Drunk Driver’s Insurer pays you the Medicare/Medicaid rate= $300

- You pay = $700

Again, the law does require the hospital to discount the amount you owe, it only states that the drunk driver’s insurer gets the discount. Instead, the law shifts some responsibility from the drunk driver or his insurer, to you the victim. The end result is you paying for someone else’s negligence. The bill amount doesn’t change, the cost is simply shifted — shifting the cost from the party who caused the injury (drunk driver) to you (the victim). If you get hurt by a drunk driver, you might be responsible for some of the bills, which turns injury law and medical bills on its head.

Conclusion of Montana’s Bad Injury Law and Medical Bills

Again, injury law and medical bills are complicated, but hopefully you will see how this new law, MCA 27-1-308, only shifts medical costs from insurers, back to you the consumer/victim. It hurts the person who is simply the innocent victim of someone else’s negligence, and helps subsidize liability insurance companies.

The legislature decided to pick winners (the bad people) and losers (victims) as a cruel way to shift costs and aspire to the ever-elusive “lower insurance rates.” This will indeed save insurance companies money, but in our experience insurer companies rarely pass that savings along to insureds and no one is looking over their shoulder to see that they do. Call it the “drunk driver relief fund” or the “liability insurance company subsidy act.”

From a practical perspective, it will be interesting to see how this plays out. Will hospitals accept the discounted payments as full? How will insurers determine the “amount for which the unpaid charges could be satisfied if submitted to any health insurance,” when the bills won’t actually be submitted to health insurance? Will the victims be left paying for bills caused by drunk drivers?

This law is simply a well-disguised subsidy to insurance companies and bad actors. It has the practical effect of making it more difficult and costly to bring claims against bad actors and insurers. Why was this law passed? Being kind, a benefit-of-the-doubt view would say the Montana Legislature was simply uninformed as to how injury law and medical bills actually worked and passed it out of ignorance; a more jaded view would say the many-involved knew exactly what they were doing and had ties to (or money from) the insurance industry that outweighed the interests of average Montanans.